An excise duty charged on passengers flying from a UK airport on an aircraft above a certain size, Air Passenger Duty (APD) ranges from £24 to £170, per passenger, per flight, depending on the distance being travelled.

An excise duty charged on passengers flying from a UK airport on an aircraft above a certain size, Air Passenger Duty (APD) ranges from £24 to £170, per passenger, per flight, depending on the distance being travelled.

Darren Caplan, chief executive of the AOA, said: “Our message to the Chancellor is that enough is enough. Air Passenger Duty has already gone up by 325% on long haul flights and 140% on short haul flights in the last five years. Family finances are under great pressure at the moment and most people save hard all year for their holiday. Working families deserve a break.”

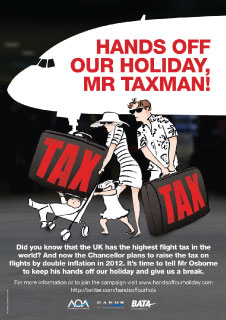

The ‘Hands off our holiday, Mr Taxman!’ campaign was launched at nine UK airports – Belfast International, Bristol, Gatwick, Glasgow, Liverpool John Lennon, London City, London Luton, Newcastle and Newquay Cornwall. The aim was to raise the profile of APD among the public, focusing on both the current internationally-high level and the impending rises due in 2012; building support from Members of Parliament (MPs) and encouraging them to lobby the Chancellor and the Treasury; and to raise the profile of APD-related issues among national and regional media.

The ‘Hands off our holiday, Mr Taxman!’ campaign was launched at nine UK airports. The aim was to raise the profile of APD among the public, focusing on both the current internationally-high level and the impending rises due in 2012.

Campaign team members were stationed at the airports handing out leaflets, and asking passengers to lobby their MP and the Chancellor to abandon the proposals to increase APD. Campaigners wore special ‘Hands off our holiday, Mr Taxman!’ branded t-shirts, handing out around 20,000 leaflets.

AOA reported fantastic results, with more than 17,000 people emailing their MPs via the campaign website. 648 out of a possible 649 MPs were contacted at least once by the travelling public. The Association itself also undertook to build political support, emailing 1,223 representatives in both the upper and lower houses of UK parliament. Beyond British shores, Member of European Parliament (MEP) Timothy Kirkhope wrote a letter to the Chancellor supporting the campaign. Finally, the campaign also used the internet and social media to generate support, with more than 70,000 unique visitors to the campaign website generating 350,000+ page views, and over 1,500 Twitter messages in support.

CI EUROPE also got involved, writing an open letter to the Chancellor which reinforced the campaign’s arguments, and drawing upon its recently-completed Position Paper on Aviation Taxes. The campaign’s online strategy was also backed up by exposure on ACI EUROPE’s Twitter feed (@ACI_EUROPE).

While the campaign is ongoing, there have been some initial signs of success, with the UK Chancellor announcing that APD rates in Northern Ireland will be dramatically cut from 1 November 2011. Seen as a response to the competitive pressures from airports in the Republic of Ireland, the move is an implicit acceptance of the tax’s adverse impacts.

Double inflation and double taxation

Significantly, the proposed double inflation APD increase would occur at the same time as aviation enters the EU Emissions Trading Scheme (ETS) in 2012. This means that the industry would be subject to a double tax charge, as well as a double inflation increase in one of those taxes. The level of tax on aviation is already high in relation to that paid by other sectors.

AOA Chairman Ed Anderson commented: “Our research has shown that passengers departing the UK can pay up to 8.5 times more in tax than the European average. Not only does this increase the cost of holidays abroad for families, it puts the UK at a significant competitive disadvantage against its European competitors, making it more difficult to attract inward investment from countries such as China and India.”

He added: “We support aviation’s introduction into the EU Emissions Trading Scheme (ETS) in 2012 as the best way to deal with emissions from aircraft in the absence of a global deal. However, as things stand, the introduction of ETS will simply mean that passengers will effectively face double taxation. We call on the Government to ensure that APD is reduced by an equivalent amount to the revenue raised by ETS. In this way we can help to ensure that aviation can play its full part in delivering jobs, export-led growth and the rebalancing of the economy, within a framework of environmental sustainability.”

Economic impact of APD

While the campaign focused on the direct impact on passengers, it is important to note that aviation taxes actually have a wider negative net economic impact, with the effect of the taxes on the economy as a whole largely outweighing the expected return from the tax. Such taxes discourage travel and reduce the connectivity of the regions. Several EU Member States, including Austria, Belgium, Denmark, France, Germany, Italy, Ireland and the Netherlands, have imposed or proposed to impose a tax on aviation. However already, there have been reversals in this trend. The Belgian Government withdrew plans to introduce a tax in November 2008, following widespread opposition. Similarly, Denmark abolished its transportation tax in 2007 as a result of the negative economic impact and competitive disadvantage for Danish airports.

Campaign team members were stationed at the airports handing out leaflets, and asking passengers to lobby their MP and the Chancellor to abandon the proposals to increase APD.

The Irish Government has announced its intention to withdraw the tax (pending airlines adding more capacity to the Irish market), having already decreased it dramatically, while, in the Netherlands, the tax was suspended in July 2009, following a dramatic negative impact on the Dutch economy.

Aviation has a key role to play in Europe’s economic recovery, contributing to economic growth by facilitating the mobility of people and businesses. While Europe’s airports support the inclusion of aviation in the EU ETS, all national aviation taxes should be withdrawn upon aviation’s entry into the EU ETS in 2012.